Standard Audit File for Tax is being introduced in Poland by the Ministry of Finance. It is called JPK - Jednolity Plik Kontrolny.

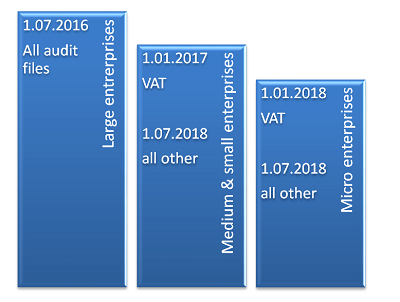

Large enterprises with 250 or more staff members (on an annual average) in at least one of the last two financial years, or which had more than the PLN equivalent of EUR 50 million in the net annual revenue from sales of goods and services as well as financial transactions, and the total assets in the balance sheet as of the end of one of those financial years exceeded the PLN equivalent of EUR 43 million are obliged to report their financial books starting from 1st of July 2016.

Medium and small enterprises are obliged to provide their date for audit purposes starting from 1st of July 2018. Until then they can deliver their data in electronic form but not obligatory (vacatio legis). The only obligation is JPK_VAT file (VAT purchases and sales records) that need to be delivered electronically starting from 1st of January 2017.

Audit documents can be:

- delivered in a traditional way

- transfered to a central system via internet using https protocol

- delivered as encrypted files on electronic data storage devices

mKsiegowa.pl is an online accounting software that complies with Polish accounting rules. We have implemented Standard Audit File for Tax requirements and the program can generate relevant XML files.

Feel free to contact us if you want to have presentation in English.